Our Process

Partner…Discover...Prepare…Execute…Succeed…!

“Alone we can do so little,

together we can do so much.”

-Helen Keller

True story – a couple rushed to the Emergency Room – the woman was experiencing extreme headaches.

When the doctor asked, “On a scale of 1-10, how bad is it…?”

She replied, “…a 15…!”

“No, I’m sorry, on a scale of 1-10…?” the doctor asked.

“…a 15!” she replied.

The doctor took the spouse aside and said they would need to get a battery of tests – she thought there might be an aneurism or brain tumor – and that they would need all medical records, including medications, and also a medical power of attorney. He panicked – and spent the next hour on the phone with the pharmacy and family MD trying to get medications and medical history…and they didn’t have a medical power of attorney.

We know:

- 70% of Americans have no plan – for their wealth or estate.

- 80% can’t locate or organize their key records and documents.

- 50% have no powers of attorney for healthcare or asset management.

- 50% haven’t organized their online passwords.

Our approach to client service respects a disciplined set of procedures to achieve successful outcomes – we stick to the basics. We call these steps: partner, assess, prepare, execute, review, succeed!

Partner…can we work together…?

First, we share our core values and commitments, our value proposition:

“We build long-term client-advisor partnerships – mutual trust is our core working value. We are selective, and we believe you must also build your advisory team carefully. If we believe we can partner with you, we will dedicate ourselves to helping, in fact challenging you to get your house in order for yours and your family’s legacy of success. We build a process to assess, prepare, execute, review and adjust this process along your critical path to success. Most importantly, we believe it means knowing what your life-goals and passions are – personal, family, community – and then living authentically to achieve those goals.”

Discover…where are you now…?

Did you know that the Apollo moon missions were never on an exact course - in fact, they were constantly checking and self-correcting their flight to stay within a "critical path”? We believe your practical life should serve your dream's critical path.

Assessment means a careful and methodical inventory, a check, of your situation, your goals and dreams, and the status of the planning you may already have in place to achieve success:

- Where are you headed – what are your life-goals and dreams…how do you envision your legacy for family or community…?

- How do the important people in your life fit into your legacy…what do you want for them, for their security and success…?

- What risk planning do you have in place – health and natural disaster…investment risk (market volatility)…estate and legal risks (medical powers, asset protection)…information security risk…?

Prepare…how do you get where you want to go…?

Organize your team: To succeed we believe you must let your assessments (above) guide and drive your planning. You take charge, partnered with a team of professional advisors – financial & wealth advisor, attorney, CPA, healthcare providers, and insurance and security advisors.

“Plan your work – work your plan…”: What did legendary coach Vince Lombardi care more about than winning…? In the eyes of his players his most important legacy came from this challenge: “Winning is not nearly as important and preparing to win…!” We believe preparation includes:

Healthcare Planning

Modern medicine will extend your life expectancy. Professional healthcare can help guide your critical path. Healthcare planning – its miracle cures but also its extraordinary costs – represents a major challenge to your security and wealth. Governments will not be able to keep their promises (see Gary’s article “America’s Egalitarian Crisis”) – you must take charge of your own health. We make sure you and your attorney get your vital healthcare documents in order. We then make sure you and your family members have an emergency healthcare security plan in order – see Security Plan, next.

Estate Planning

Modern lifestyles require a legal foundation not merely for end-of-life events but more importantly to preserve the integrity and management of your practical life during an unexpected emergency or incapacity - powers of attorney are vital. We stress “people over paper…” – a working relationship with your legal professional is a key to success. Proper planning includes wills and/or trusts, medical and durable powers of attorney, and living wills, all of which help sustain and care for your family and preserve your life's achievements and legacy. We team with your current attorneys, or help you locate estate attorneys in the local community, to help ensure your peace of mind. In this vital area, Gary carries the Accredited Estate Planner (“AEP” - 1993) professional designation. See “Our Qualifications.”

Wealth Management

Risk and reward are complex challenges - your investments are flowing like a wave in and through the complex, unpredictable, and volatile global capital markets. To navigate the future, we believe your total assets must include secured, income assets, yet also some assets that can grow to keep pace with inflation.

A viable asset pyramid includes: Foundation: lower risk, conservative assets including pensions, bonds, annuities, or CDs. Core: moderate risk assets including diversified stocks, real estate, and other managed instruments. Peak assets:higher risk assets such as concentrated stocks, less diversified real estate investments, or assets you may intend to gift to family or charity. For many clients we build socially responsible-sustainable-environmental strategies (“SRI-ESG”) to express their life-values into their asset values. Gary carries the Certified Investment Management Analyst (“CIMA” - 1999) professional designation and is a member of Investments & Wealth Institute.

Financial Plan

Successful planning coordinates several disciplines – financial, estate, wealth, tax, insurance and security plans, as well as healthcare. It’s comprehensive because it integrates your various planning objectives, but also because it must be comprehended by you, your team, and your family. Our planning platform, eMoney, provides a suite of services – asset inventory & tracking, real-time planning, secure client web access as well as document management and storage (legal docs, insurance, etc.), and client education modules. Gary is a Chartered Financial Consultant (“ChFC” - 1986) and member of the Society of Financial Service Professionals.

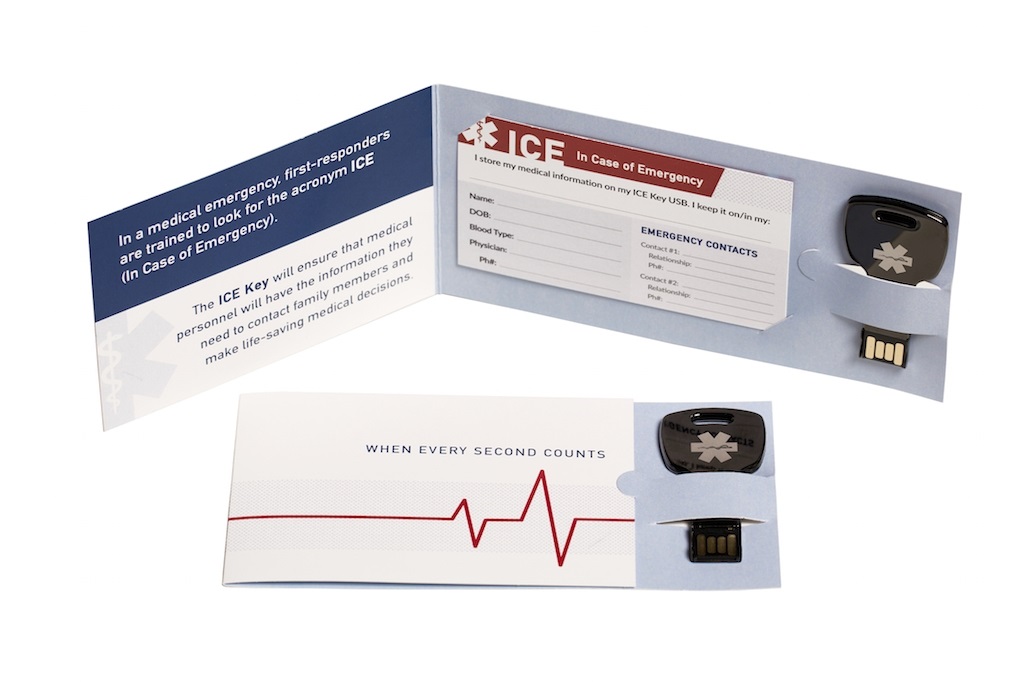

Security Planning

Modern lifestyles are now technological as never before and getting more complex every day. Basic insurance planning – property, life and disability insurance, healthcare insurance – must be in place, and reviewed and adjusted periodically. We are keen on emergency planning – we insist our clients and their children carry an “ICE” (“In Case of Emergency”) key-chain USB that provides emergency responders with key medical data and legal documents, including medical powers of attorney. Gary is a Chartered Life Underwriter (“CLU” - 1987) and a member of the Society of Financial Service Professionals.

Execute...

We help clients get their house in order so their practical lives can serve their life-goals. Success means having systems in place – for everyday living as

well as unexpected emergencies. Execution includes performance review and, yes, course adjustments along a critical success path.

Succeed...

To recap, just as the Apollo missions were constantly checking and self-correcting their flight, we believe your practical life should serve your dream's critical path.