Our Client Map – Read this article first:

“Don’t Sweat the Small Stuff…Do Sweat the Big Stuff”

“The pessimist complains about the wind;

the optimist expects it to change;

the realist adjusts the sails.”

William Arthur Ward

The “small” stuff:

The media bombards us every day with basically three messages:

- “Buy this car…”

- “Buy this pharma…”

- “Get this financial service or product – a plan, reverse mortgage, gold-silver IRAs, low-cost brokerage…”

So, research the car if you need one, get a good doctor and a regular check-up, and, if you are so inclined, connect with advisors (JD, CPA, financial advisor) and get a plan to take care of business:

Get a plan:

- Your “living” plan: kids’ education, investment strategy, risk management (life, health, disability, property insurance, long term care), retirement plan.

- Your “legacy” plan: will or trust, powers of attorney (medical, durable), a wealth legacy strategy.

As the comedian proclaims: “Get ‘er done!” Just remember that the “big” stuff is the real stuff – like driving your car safely and avoiding disastrous accidents, like getting “outside the box” med check-ups (heart scans, colonoscopy, ultrasounds, etc.) to detect life threatening illness, or avoiding catastrophic financial or legal or property losses.

The small stuff is what you can see and touch and take care of immediately. So, in the wealth management world as you establish both living and legacy plans for you and your family, as you get a “retirement” or “financial independence” plan in place, or education plans for kids, you will likely be ahead of @80% of the American public who neglect to get solid plans working.

So, what’s the “big stuff”?

The “BIG” stuff:

"The will to win is not nearly so important as the will to prepare to win.”

Vince Lombardi

To hike, let’s say, close to home here in Colorado, Long’s Peak (its native Arapaho name is “Neníisótoyóú'u” pronounced “nes-o-táy-o”, or “the Great Sentinel”) get the “small stuff” done first: mountain gear (hiking boots or shoes, helmet, wind and rain gear, water bottles, sunglasses & sun block for skin, light foods), then get on the mountain by 5AM and off the peak by Noon, and tell someone you’re climbing.

OK, so again, what’s the “BIG” stuff…? – these are all the more subtle yet vital, and likely more difficult tasks, like teaming up with reliable hiking buddies, getting in top shape – especially your heart and lungs, being prepared for altitude sickness, tracking the weather – lightening-wind-rain-snow, or if it’s a clear summer day be ready for silly and unprepared homo sapiens – lots of ‘em, and most importantly BE WILLING TO RETREAT SAFELY – KNOWING YOUR OWN LIMITS, ACCEPTING THAT THE TREK DOWN IS MORE DANGEROUS THAN THE TREK UP. In a nutshell, be prepared to be shocked, surprised, by the unpredictable and even unknown risks, in a nutshell, being aware that you can’t always predict or control the really dangerous stuff.

A solid approach to guiding your wealth planning spins this “small – big stuff” rule. Get the small “inside the box” stuff in place, and then educate and become more aware of the “outside the box” stuff – the unpredictable, the volatile, the hidden or unseen.

In the “Gary’s Articles” tab on this web site, you will find various quick-read articles that introduce some of the “big stuff.” Here’s a quick summary:

- The 21st Century Global Economy: Sex, Tech, & Capital – a quick yet deeper view of what drives this amazing yet dangerous, re-emerging global economic system.

- The Government Cannot Keep Its Promises – why Social Security, Medicare, and Medicaid cannot be relied upon and may threaten yours and your family’s well-being.

- China Syndrome: 21st Century Miracle or Meltdown? – why and how China poses at once amazing potential yet at the same time represents a dangerous, disruptive, and unprecedented threat to the global economic-political system.

- Hang On! Investing in the 21s Century is a Rodeo…! – why and how modern finance and the high-tech wired markets have increased your portfolio risk and volatility.

What to do? First, read, meditate, think about your well-being, discuss it with your loved ones. Second, act, get moving. Third, review regularly, and repeat one and two.

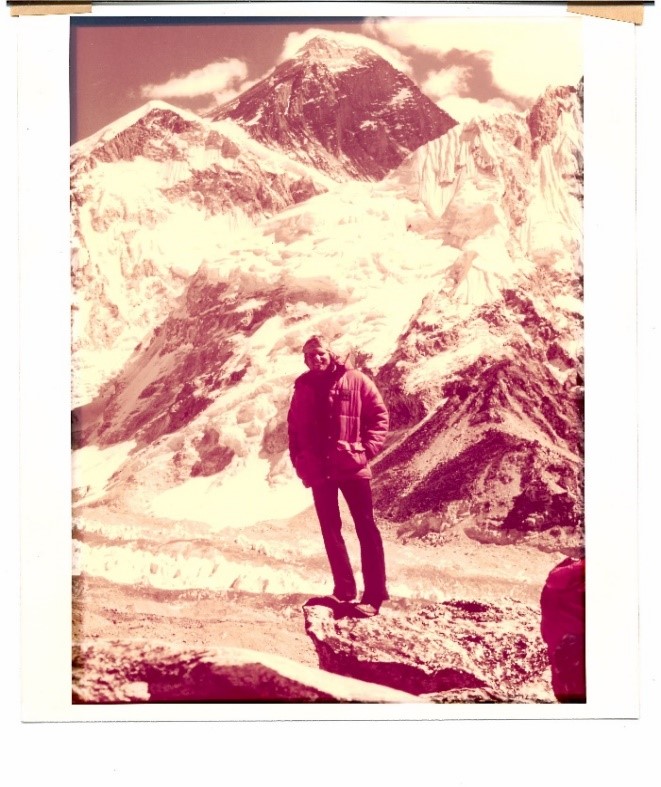

Gary, trekking in Nepal, atop Kala Patar, @18,000 feet, April 1977; Everest in background.