The Government Can’t Keep Its Promises” – America’s Egalitarian Crisis

"It’s been said that Democracy is the worst form of government except all those other forms that have been tried from time to time.”

Winston Churchill

“We’re busted baby! Who’ll foot the bill for aging populations.”

Terry Jones, Investor’s Business Daily, 7-1-2019

At a 2016 Beaver Creek, Colorado firm retreat, keynote speaker Brian Wesbury, 1st Trust Portfolios’ Chief Economist and a highly regarded market analyst, was asked “…what can our clients expect from Social Security, Medicare, or Medicaid in retirement?” Brian’s response: “The government won’t keep its promises. I tell my own kids not to rely on social programs. Period.”

What’s your expectation? Who is your key financial and social benefits partner? Based on the taxes you pay, it’s probably various government safety net programs. In 2018, a family with $150,000 taxable income would have a total IRS tax burden (income tax employer+employee FICA1 taxes) of @$47,000. Yet Social Security and Medicare, as well as Medicaid, may very likely not be unable to meet their future obligations:

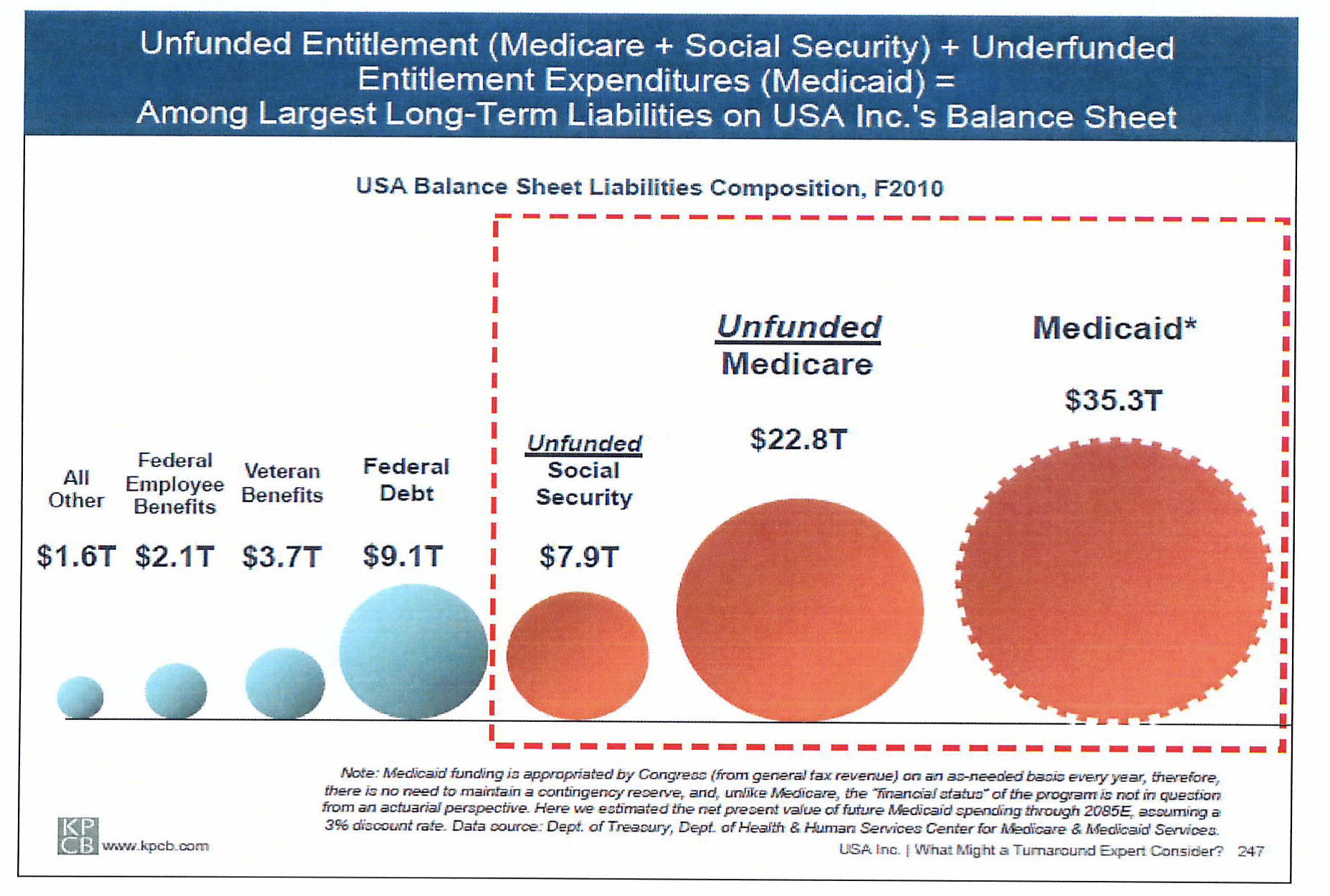

The chart above reflects 2010 liabilities - as of 2018, Social Security liabilities are estimated to be of @$17T, and Medicare @$28T2. This is Washington’s hidden “entitlement secret.” For all Americans it is a full-blown egalitarian crisis.

How did we get here? The 19th century industrial and urban revolutions, which moved masses of Americans into unregulated factories and over-crowded cities, eventually spurred the creation of a social safety net – first railroad pensions leading to FDR’s 1939 Social Security Act and urban health programs which eventually created LBJ’s 1965 Medicare. Programs inspired by noble intentions.

However, public policy leaders from both sides of the isle, as well as the finance profession in general, all avoid or defer honest discussion of the under-funding problem. Some even propose larger entitlement programs.

All generations are impacted. Social Security represents @40% of elderly income, yet its trust fund is expected to be depleted by @2035-40 – payroll taxes will then cover only 79% of scheduled payments from 2034 and beyond.3 Younger generations may expect little or no benefits yet may be unaware that they will be on the hook for these liabilities after their parents and grandparents have passed on.

How to plan? We believe you and your advisors must be proactive. First, discuss these issues with your family and your advisors. Second, expect some reform measures: higher payroll taxes; expect normal retirement age to be shifted from the present ages 62-70 to 70-75; expect benefits to be limited for higher income and net worth retirees. Third, start as early as possible to create secure private retirement and medical fund reserves, ideally plans where investment principal can be accessed for medical costs not covered by government programs.

In summary, start early, get younger generations aware and involved, and be proactive to make your family as free as possible from entitlement dependence.

Other Nations’ “Fixes” to Pensions & Social Security4

Falling birthrates and generational changes (“demographics”) across the globe are the primary contributors to the public pension crisis – shrinking younger generations to support the largest older generation in history. To sustain “stable” populations, a culture’s fertility birthrate must be supported by 2.1 births/woman – in 1950 the United Nations reported a global fertility rate of 4.7, yet by 2017 that rate had fallen to 2.4. Developed nations are now well below replacement fertility: Europe (1.6), United States (1.9), Japan (1.4), and the developing and most populous nation China (1.6).

We see examples of how other countries are shifting to personal savings programs which include investment market (that is, stocks and bonds) to adjust the gaps in public pensions:

Netherlands: The Dutch system provides a public or state-sponsored $11,000 annual retirement income (@45% of total “basic” needs), with the remainder provided by mandatory private workplace savings (45%) and personal accounts (10%).

Finland: The Finn’s are moving “normal” retirement age from 59 to 65. Government, private sector business, and workers are cooperating to ensure their system’s solvency, and when in 2018 studies predicted declining population statistics as early as 2035 the three immediately responded by pledging fiscal support – “The faster we react, the more likely we can avoid ending up in a…situation in which the pension age is raised or benefits are cut.”

Australia: Aussies receive a government-financed “safety net” benefit, but the lion’s share of retirement income is provided by their “superannuation” system which requires workers to invest in private-sector funds – these funds now total more than $2 trillion for a population of just 25 million, or about the same as Southern California.

Sweden: The Swede’s began reforming their system in 1998 by capping outgoing benefits to expected contributions – a formula which then automatically adjusts to changes in income and population growth. In addition to this basic benefit, mandatory private savings accounts similar to the US “IRAs” or “individual retirement arrangements” then supplement future income needs.

Conclusion: Public pension reform appears doable when three efforts are in place:

First: Sustaining a publicly sponsored “basic safety net”.

Second: Mandatory privately funded investment-driven supplemental savings.

Third: Cooperation between government, private sector employers, and workers.