China Syndrome 21st Century – Financial Miracle or Meltdown

“Debt repayment pressure on some local-government debt is massive, and is a hidden danger…If we let debt risks continue to accumulate, they will be bound to transmit to the financial world, triggering systemic financial risk.”1

Liao Ziaojun, Director of the Budgetary Affairs commission for the National People’s Congress’s Standing Committee, 2015

In May [1989], Deng Xiaoping declared martial law and rushed 250,000 troops into the Chinese capital. …Hundreds, and perhaps thousands, of unarmed Chinese students died in the streets…Within a year of the massacre, the Chinese government “had closed 12% of all newspapers, 13% of social science periodicals, and 76% of China’s 534 publishing companies, “according to the political scientist Minxin Pei. It also seized 32 million books, banned 150 films, and punished 80,000 people for media-related activities.2

Michael Pillsbury, The Hundred -Year Marathon, 2015

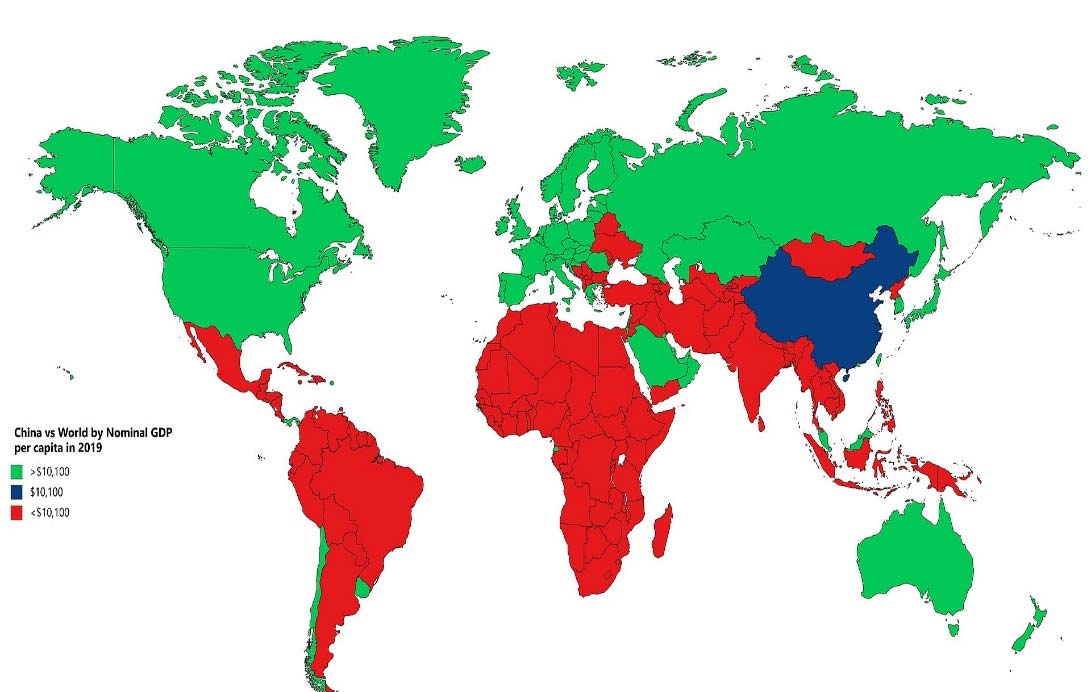

China formally re-entered the modern global economic community when it joined the World Trade Organization (“WTO”) in 2001 – since then, the world’s most populous country has accounted for @30% of the growth of the world economy3 and now produces roughly 18% of world “gross domestic product”4 (“GDP”). By sheer size, China’s economy (and India) will likely surpass U.S. GDP in this century. Asia is now a big piece of the global pie.

Questions arise:

1) What is different about China’s “market-economy?

2) Has investor risk increased or decreased as a result of China’s re-emergence?

3) What’s the takeaway for investors?

China 1949-Present: China emerged from WWII one of the globe’s poorest economies and still in the throes of a civil war that began in 1927 between the Nationalist Party of China (Kuomintang or “KMT”) led by Chiang Kai-shek, and the rising Communist Party of China (“CPC”) led by Mao Zedong. By 1949 Mao’s forces had prevailed, establishing the People’s Republic of China (PRC), while Chiang Kai-shek fled to the island of Taiwan. And notably, to date no armistice has been signed and many contend the civil war has not officially ended.5

Under Mao’s leadership China struggled to re-establish itself and initially used the Soviet “central government” model. This period included two economic and humanitarian catastrophes: First, the “Great Leap Forward” (1958-1962) which attempted to collectivize agriculture and close small farms, yet which led to the deaths of tens of millions due to management failure coupled with famine brought on by inclement weather; and second, the “Cultural Revolution” (1966-1976) launched by Mao in an attempt to enforce communist institutions by purging remaining capitalist and traditional elements, yet which also claimed millions of lives, caused economic production to plummet, and severely disrupted China’s development.6

Source: https://www.britannica.com/biography/Mao-Zedong/media/363395/69361

Political turmoil ensued following Mao’s death in 1976. Deng Xiaoping, who marched with Mao in the Long March of 1934-35 yet was also jailed during the Cultural Revolution, emerged as the architect of China’s economic reform. Deng instituted a new global-leaning “Open Door Policy,” which brought foreign corporate investment under strict PRC control and employed 2000+ “Special Economic Zones”7, a revival of small business entrepreneurship and family-run farms, and the “Four Modernizations” of agriculture, industry, defense, and science & technology. Deng the pragmatist quoted an ancient Szechuan proverb to inspire the Chinese pivot: “It doesn’t matter if the cat is white or the cat is black if the cat catches the mouse.”8 Under Deng’s policies from 1989-1990, China re-emerged in the global community, and its new, Chinese version of state-controlled capitalism can reasonably be seen as one of the great “open- market” miracles of the 20th century: “Nobody has done more to liberate more people than Deng Xiaoping – an ardent communist and veteran of the Long March.”9

China’s Economy: While China has been an engine of global economic growth, because of its enormous scale and its much less transparent, controlled economy, it poses substantial and largely unpredictable risks to investors. Many observers worry about its debt levels: Ruchir Sharma, the chief global strategist at Morgan Stanley Investment Management, observes “In the post war period, every previous global recession started with a downturn in the United States, but the next one is likely to begin with a shock in China...China’s miracle growth period is over, and it now faces the curse of debt.” 10

What has fueled China’s meteoric growth? It’s important to note that prior to the 18th century’s Industrial Revolution, the agrarian based economies of China and India were always the world’s largest economies by sheer population. However, from 1750-1900, rapid economic changes enabled by new technologies (steam power and electricity, global shipping, corporate industrial organization, modern finance) transformed the global playing field. China and India, both 5,000-year-old cultures, were slow to adjust and by 1900 had not only been left behind but also came under the exploitation of the industrial, globalizing nations, most notably the British Empire.

The 20th century’s two world wars were triggered by the violent competition for global commodity resources required to fuel the new, high-production industrial models. However, following World War II the developed nations’ colonial power shrank dramatically (Japan and Germany by defeat, and Britain due to war debts), which opened the way for both India (1947) and China (1949) to achieve political independence. Both nations have since re-emerged as major global political and economic players, particularly in the Asian theatre. What factors make China’s economy unique?

First, China is in principle a bureaucratic-authoritarian, one-party system, a vast bureaucracy run not by a single dictator but rather by @86 million Communist Party members or 5% of the population. The Party’s “Organization Department” appoints virtually all top officials, including the government, universities, religious organizations, the courts, but also the media and both state-owned and private large corporations. However, in day-to-day practice, China’s governance is substantially de-centralized and run at a local, provincial level. The most telling indicator of decentralization is China’s total government spending – according to the International Monetary Fund (IMF) the average percentage for local public spending outlays for democracies is @25% and for non-democracies @18%, while China’s has risen from 54% (1958-2002) to @85% by 2014. The provinces are under enormous pressure to raise public revenue, and in fact must find revenue outside of conventional public taxation. So while China’s long history has always favored large bureaucratized governance, with rival provinces often at war with one another, what is unique to the Communist era thus far has been its ability to unify and control its diverse provincial sectors.11

Second, the Chinese people save substantially more of their incomes than, for example, Americans, and until recently their investment alternatives were limited to bank savings. PRC controlled banks have substantially used the savings of Chinese workers and families to lend to over 150,000 state-owned or controlled industrial companies (including the world’s second- biggest aluminum company, the world’s 5th, 6th, and 11th largest steel companies, and two of the world’s largest shipbuilders12) as well as real estate developers. Between 2007-2014, Chinese corporate debt, which is much less transparent than bank balance sheets, has increased from @$3.4 to $12.5 trillion, and large amounts of that debt is held in non-producing, even derelict industrial companies and in empty high-rise apartment buildings. Of concern is not merely the scale of corporate debt but how quickly it has accrued, from 120% of GDP in 2011 to @163% by 2015. By comparison, over the same period corporate debt in other developed economies has remained relatively steady - South Korea (105%), the US (71%), and Germany (52%).13

Source:https://en.wikipedia.org/wiki/Real_estate_in_China#/media/File:NewSouthChinaMall-DownEmptyHall.JPG Public Domain, https://commons.wikimedia.org/w/index.php?curid=9489859

Third, China’s growth has been fueled by land. The provincial PRC governments sell land leases (generally, land cannot be owned privately in China which is controlled by the PRC) and from 2009-2015 this policy has displaced as many as 65 million Chinese, a population the size of the U.K., selling leases to raise public revenue for government-directed development. Because PRC taxing capacity is stretched to its limits, land lease sales account for roughly one- third of government fiscal revenue, or equivalent to the U.S. Congress selling enough land each year to cover the U.S. military budget and most of its Social Security spending.”14

To briefly summarize, the modern Chinese political economy is entirely unique – both communist and capitalistic, in part centrally controlled yet significantly locally financed, from one take its system has liberated its people’s economic prospects, yet at other times it has viciously oppressed its people as in the May 1989 Tiananmen Square student uprising. Since 1978, its meteoric rise has stunned observers and challenged open-market growth assumptions. Yet its trail of success is obscured by unknowns – debt, land-lease sales, corporate and bank balance sheets, and increasingly oppressive public governance. And because as much as 30% of global GDP growth is attributable to the China “phenom,” investors face unknown and unpredictable systemic risk.

Other concerns: China will be challenged in the decades ahead by the “middle income trap.” This demographic factor was first observed by World Bank economists, who observed that of “...101 developing economies in 1960 [which] could be classified as...“middle income” (that is, they weren’t stuck in poverty, but they didn’t qualify as developed nations either), only 13 – a group that includes Japan, South Korea, Singapore, Israel, and Ireland – managed to become rich nations by 2008.”15 Emerging economies that were initially on growth trajectories later slowed and then failed to reach sufficient per capita incomes to provide for their aging population.

China’s 1978-2015 “one-child” policy also contributed to smaller younger generations and heightened the middle-income and legacy cost factors. The “legacy cost” problem, where older generations grow larger than the younger supporting generations, is another way to view this problem. While legacy costs (pension and medical resources for the aging) are also affecting both Western Europe’s and Japan’s economies, these economies reached greater per capita income levels and may be better able to absorb the legacy cost burden. China’s population is much larger with extremely ambitious goals to move hundreds of millions of its people from rural, agrarian lifestyles to urban, production economy lives by 2050. Because of its legacy cost burden the middle-income trap is more challenging.

Source: By Radom1967 - Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=75623059

Can China’s economy grow fast enough to catch up with its legacy costs? In a recent 2015 speech, Chinese Finance Minister Lou stated, “In other countries, this process – of property rights opening up, allowing the trade of land – took twenty years to evolve, but China, owing to the problem of growing old before growing rich, only has five to ten years to make the adjustments.”16

Takeaways:

Is “big” the best system? China may, by sheer scale of its population, re-emerge as the largest economy as measured by gross domestic product (GDP). China is a vast and still largely untapped economy that will continue to contribute to positive growth of the global economy. However, whether it also becomes the best modern economy remains to be seen. It is far too early to say how it’s unique version of state-controlled capitalism will pan out, but it is clear that, given the above challenges and hidden factors in its recent growth pattern, there remain very substantial causes for concern and even alarm.

Has investor risk increased or decreased as a result of China’s re-emergence? Investor risk has clearly increased given the above factors but also given current high market valuations.

What’s the takeaway for investors? Projecting forward, investors should plan on increased risk and volatility, especially with high market valuations. Investor portfolios of stocks, fixed income debt and bonds, and real estate, are now subjected to a global economy with new and very substantial players. The large, emerging economies of China (and India) are less transparent and express different cultural and economic value systems, and they are just now emerging in a big way into the constantly evolving global economy.

1 Dinny McMahon, China’s Great Wall of Debt: Shadow Banks, Ghost Cities, Massive Loans, and the End of the Chinese Miracle, New York: Houghton Mifflin Harcourt, 2018, p. 70.

2 Pillsbury, Michael, The Hundred-Year Marathon – China’s Secret Strategy to Replace America as the Global Superpower, New York, 2015, 2016, St. Martin’s Griffin Edition, p. 83.

3 https://www.statista.com/statistics/270439/chinas-share-of-global-gross-domestic-product-gdp/

4 Gross Domestic Product (GDP) is a broad measurement of a nation’s overall economic activity. GDP is the

monetary value of all the finished goods and services produced within a country's borders in a specific time period

Source: https://www.investopedia.com/terms/g/gdp.asp

5 https://en.wikipedia.org/wiki/Chinese_Civil_War

6 https://en.wikipedia.org/wiki/Great_Leap_Forward; https://en.wikipedia.org/wiki/Cultural_Revolution

7 A special economic zone (SEZ) is an area in which the business and trade laws are different from the rest of the country. SEZs are located within a country's national borders, and their aims include increased trade balance, employment, increased investment, job creation and effective administration. To encourage businesses to set up in the zone, financial policies are introduced. These policies typically encompass investing, taxation, trading, quotas, customs and labour regulations. Additionally, companies may be offered tax holidays, where upon establishing themselves in a zone, they are granted a period of lower taxation.

Source: https://en.wikipedia.org/wiki/Special_economic_zone

8 Old Szechuan proverb.

9 Lindsey, Brink, The Invisible Hand vs. the Dead Hand,” in International Political Economy, 2nd Edition, ed. C. Roe Goddard, Patrick Cronin, & Kishore C. Dash, Boulder, Colorado: Lynne Reinner Publishers, 2003; reprinted from Global Fortune: THE stumble and Rise of Capitalism, ed. Ian Vasquez, Washington D.C.: The Cato Institute, 2000, 43-53.

10 Ruchir Sharma, “How China Fell Off the Miracle Path”,

Source: https://www.nytimes.com/2016/06/05/opinion/sunday/how-china-fell-off-the-miracle-path.html

11 Arthur R. Kroeber, China’s Economy – What Everyone Needs to Know, Oxford University Press, 2016 12 Dinny McMahon, China’s Great Wall of Debt, 2018, p. 30.

13 McMahon, 2018, p. 32.

14 McMahon, 2018, p. 78-80.

15 McMahon, 2018, p. 172. 16 McMahon, 2018, 175